new mexico gross receipts tax calculator

However in addition to the TPT cities and counties have the ability to add various local taxes to the total compounded rate. On 6281992 at 115734 a magnitude 76 62 MB 76 MS 73 MW Depth.

What Are Gross Receipts Definition Uses More

Net earnings X 9235 the amount subject to self-employment tax.

. But theres another tax break you might be able to claim. Are You Subject to. Check your eligibility for a variety of tax credits.

Gross income client invoices records of goods sold salaries sales records last years tax return if applicable receipts for office supplies etc. Streaming services are non-taxable in New Jersey. So for people new to business ownership I want to provide a really quick overview of the basics.

Find high-quality accounting partners. The IRS recently released guidance Rev. It is a gross receipts tax which means that the taxes are levied from the gross receipts of each vendor as opposed to the liability of the buyer although vedors can pass the TPT on to the buyer and most do.

Enter the Lifetime Learning Credit. Delaware doesnt have a sales tax but it does impose a gross receipts tax on businesses. Gross earnings - business expenses net earnings.

Businesses that sell services across multiple states need to know where those services are subject to sales tax. Washington has no state income tax. Compare your tax burden in different.

You can use it to pay for courses at a college university or trade school. That exemption disappears for the 2021 tax year so youll owe federal income taxes on the entire amount you receive when you file taxes in 2022. 266366 Median gross rent in 2019.

However revenue lost to Washington by not having a personal income tax may be. Remember that sales tax rates. Periodically reevaluate your methods.

Las Cruces New Mexico detailed profile. However no clearly stated. The fact that sales tax laws often change makes it challenging to remain in compliance.

Determine your tax obligations. Also there is an Additional Medicare Tax of 09 that only applies if your income exceeds 200000 if filing as a single person or more than 250000 if married and filing jointly. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor vehicle sales and use tax.

You can use this tax calculator to. It must be noted that for rentals lasting longer than. However local governments collect additional taxes of their own which average 271 but can be as high as 431.

Having a separate bank account keeps records distinct and will make life easier come tax time. March 2019 cost of living index in Las. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Calculate your expected refund or amount of owed tax. Still others like Texas and Minnesota are actively expanding service taxability. Percentage of the Population Over 65.

Credit card and other receipts invoices mileage logs and canceled checks. Keep employment tax records for at least 4 years after the date that the tax becomes due or is paid whichever is later. 2021-49 on the timing of gross receipts and tax-exempt income from the forgiveness or partial forgiveness of Paycheck Protection Program PPP loansPPP loans were created by the Coronavirus Aid Relief and Economic Security CARES Act which provides for forgiveness if loans proceeds are used.

Be informed and get ahead with. Most transactions are subject to New Mexicos gross receipts tax the states version of sales tax New York Digital products are tax exempt in New York. Once you back up save or make digital copies of your records.

New Mexico requires a remote business to register for New Mexico gross receipts tax by January 1 of the year following the year it crossed the economic nexus threshold. Estimate your federal and state income taxes. Washington Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate.

This affordable community lets you kick back and relax without having to worry about having to stretch a fixed income to fit an untenable budget. Washington is one of seven states that do not collect a personal income tax. If youre a new business owner in Washington State the gross receipts tax also known as Business Occupation tax or BO tax you pay can seem a little tricky to understand.

This policy intervention is an effort to decrease obesity and the health impacts related to being overweight. Effective immediately after the Wayfair ruling June 21 2018. It is 703 greater than the overall US.

Townhouses or other attached units. The Lifetime Learning Credit is worth up to 2000 per tax return. After youve legally registered your business youll need somewhere to stash your business income.

A significant decline in gross receipts occurs when a businesss gross receipts in a 2020 calendar quarter are less than 50 of its gross receipts in the same quarter in 2019. Income Tax Calculator 1. Any rentals for less than thirty days are considered to be subject to a gross rental receipts tax at the rate of 10.

If youre itemizing your deductions keep receipts for these. Albuquerque-area historical earthquake activity is significantly above New Mexico state average. Calculate the amount that equals 9235 of your net earnings which is the amount subject to self-employment tax.

Every small business is different so the information needed will differ but will generally include. If youve bought or sold mutual fund shares stocks or other. When comparing this gross receipts tax to the sales taxes in other states New Mexico comes in slightly higher than average.

Delawares gross receipts tax is a percentage of total receipts from goods sold and services rendered within the state and it ranges from 00945 to 07468 as of February 2022. This includes products transferred electronically such as music ringtones. The statewide rate is 5125 which ranks in the bottom half of all states.

If gross receipts have not declined by more than 50 the test is performed. New Hampshire and Tennessee didnt tax earned income either but they did tax investment income in the form of interest and dividends at 5 and 1 respectively for the 2020 tax year. Only the Federal Income Tax applies.

Open a bank account. Delaware Hawaii New Mexico and South Dakota tax most services. As long as the information is visible and legible your scanned receipts and statements are acceptable as a proof records for the IRS purposes.

Somerton is a charming town near the US and Mexico border that lets retirees enjoy some well-deserved peace and quiet retirement years. A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of drinks with added sugarDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. By recording half of your self-employment tax as an adjustment to your gross income youll be required to pay less income tax overall.

It comes with a gross income limit of 69000 or 138000 if you file jointly. VIII - XII earthquake occurred 5680 miles away from the city center causing 3 deaths 1 shaking. Mean prices in 2019.

Were proud to provide one of the most comprehensive free online tax calculators to our users. New Mexico Digital products are taxable in New Mexico. Here are the steps to calculating the self-employment tax.

Businesses may begin by comparing the first quarter of 2020 to the first quarter of 2019. Changes to New Mexico tax law.

What Is Gross Receipts Tax Overview States With Grt More

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

What Is Gross Receipts Tax Overview States With Grt More

Profit And Loss Statement For Service Business Template Profit And Loss Statement Learn Accounting Income Statement

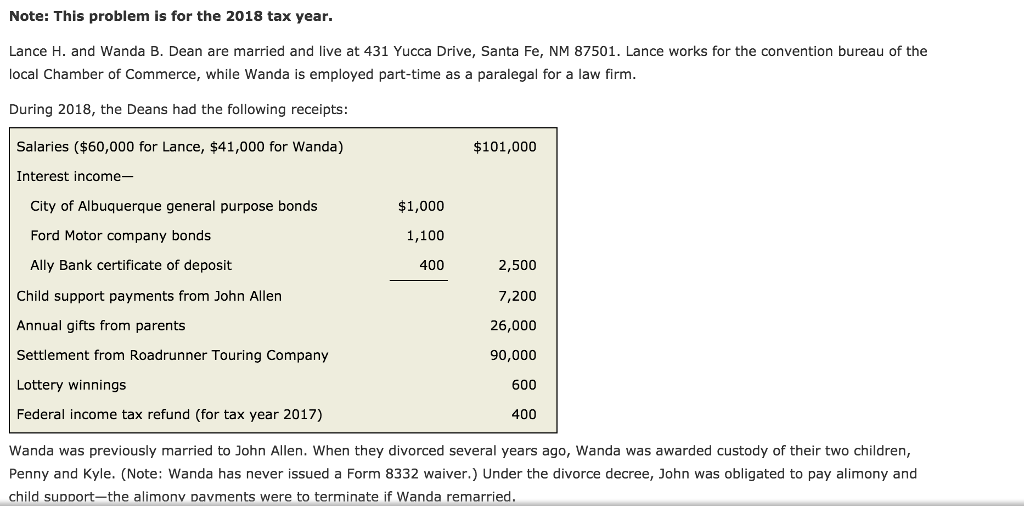

Note This Problem Is For The 2018 Tax Year Lance H Chegg Com

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

-1.webp)

Calculating Gross Receipts Larry Hess Cpa Albuquerque

Regions Bank Statement Template Chase Bank Statement Line Template Statement Template Bank Statement Personal Financial Statement

State S Gross Receipts Tax It S Complicated Resource Tool For Start Up And Small Businesses In New Mexico

How Is Tax Liability Calculated Common Tax Questions Answered

Gross Receipts Location Code And Tax Rate Map Governments

Need A Household Employer Unified Registration Form Here S A Free Template Create Ready To Use Forms At Formsbank Com Registration Form Employment Form

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

Form 1099 Misc 2018 Credit Card Services Form Electronic Forms

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return